Low contribution margin

For other types it can be more subtle such as regulations and insurance needs. The amount thats left over is the combination of.

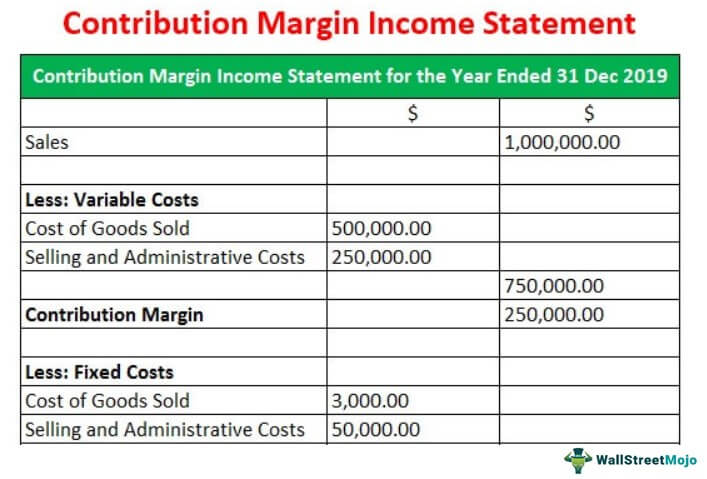

Contribution Margin Income Statement Explanation Examples Format

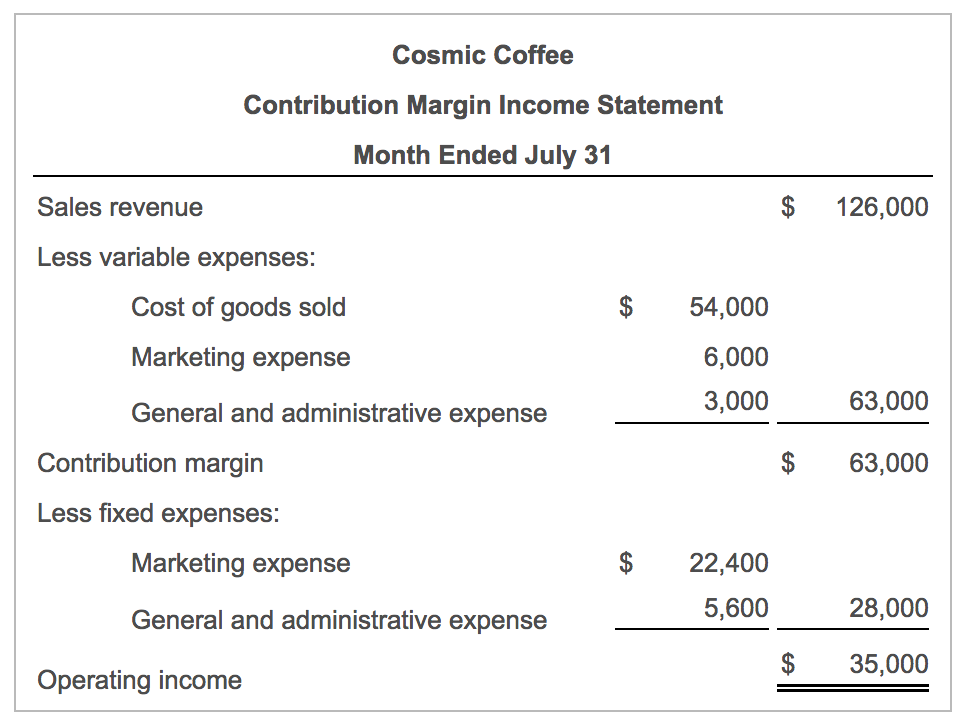

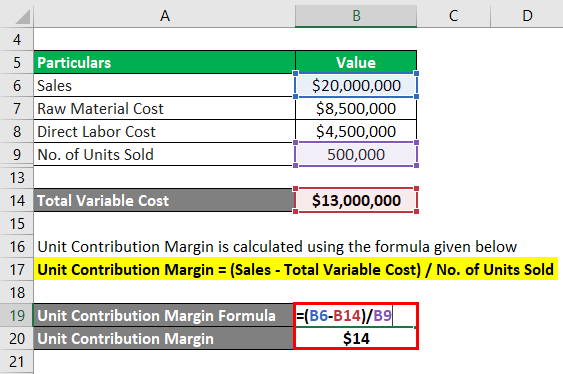

Equals total fixed costs the contribution margin ratio.

. Therefore it is not advised to continue selling your product if your. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. Eliminating low contribution margin products can positively impact a.

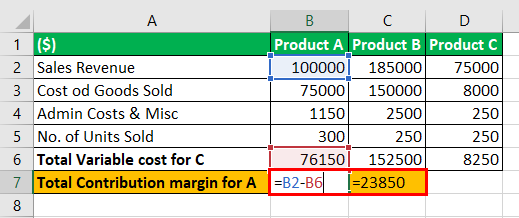

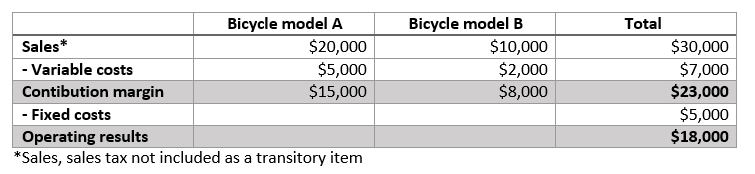

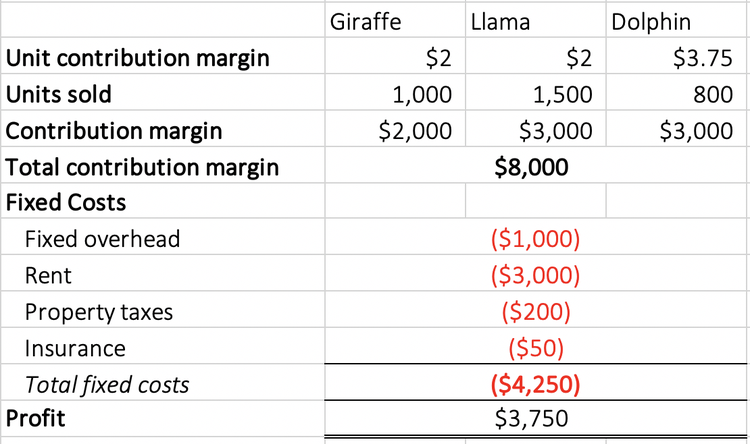

In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can. Contribution margin can be used to examine. To earn a target.

But this same café also sells muffins. The grilled cheese sells for 8 with 2 in variable costs for a 6 or 75 contribution margin. The reasons for these low-margin business types vary as can be considerable.

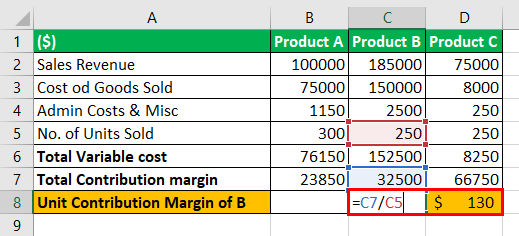

The contribution margin per unit is calculated as. The 500000 in total contribution margin is the same as 1 million bottles multiplied by the unit contribution margin of 50 cents 50 cents x 1 million 500000. If the contribution margin is extremely low there is likely not enough profit available to make it worth keeping.

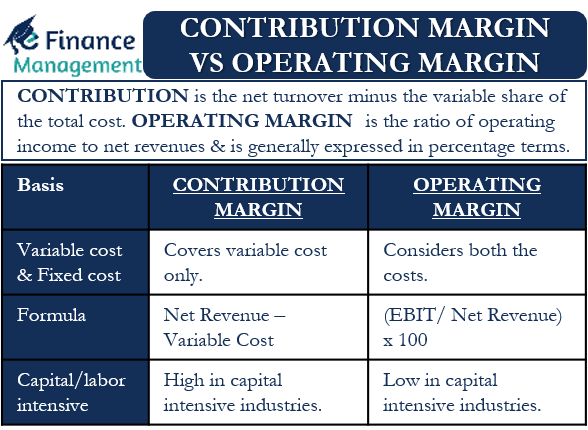

The contribution margin ratio shows a margin of 60 600010000. A low contribution margin may be entirely acceptable as long as it requires little or no processing time by the bottleneck operation. It is considered a managerial ratio because companies rarely.

When a product has a low contribution margin it is not spinning off much cash and so should be considered for replacement. On the other hand a low contribution margin percentage indicates that profits are low but the price per unit is high. An alternative is to raise the price of the product to.

That sounds like a good result. Eliminating low contribution margin products can positively impact a. Gross margin encompasses an entire companys profitability while contribution margin is more useful on a per-item profit metric.

Low contribution margins are present in labor-intensive companies with few fixed expenses while capital-intensive industrial companies have higher fixed costs and thus. Contribution Margin Ratio Contribution MarginNet Sales Sales Variable CostsNet Sales. It is reported on page 1 of The Courier FastTrack as an aggregate.

The low variable cost with the grilled cheese is due to Laina using reliably. - expressed as a percentage of sales. Equals total fixed costs the contribution margin price - variable cost per unit.

Contribution margin is revenue minus labor material and inventory carrying cost. Say a machine for manufacturing ink pens. A company sells Product Z for 15000.

If the contribution margin is too low or is negative this will mean loss for the company. Calculating a contribution margin. The Revenue from all muffins sold in March is.

In addition you should also know the performance of the market as long. If the contribution margin is extremely low there is likely not enough profit available to make it worth keeping. The contribution margin is the difference between sales and variable costs.

Unit Contribution Margin Meaning Formula How To Calculate

Average Profit Margin By Industry Business Profit Margins

What Is Contribution Margin

Contribution Margin Formula And Ratio Calculator

These Industries Generate The Lowest Profit Margins

Contribution Margin And Operating Margin Meaning Differences Merits

Contribution Margin Ratio Formula Per Unit Example Calculation

Contribution Margin Vs Gross Margin Top 6 Differences With Infographics

Gross Profit Margin Vs Net Profit Margin Formula

Contribution Margin Formula And Ratio Calculator

What Is The Contribution Margin Definition And Calculation Ionos

/ScreenShot2021-05-28at7.09.49PM-f53a583c48954953a7cd0d23454be040.png)

The Profitability Ratio And Company Evaluation

How To Calculate The Unit Contribution Margin

Unit Contribution Margin How To Calculate Unit Contribution Margin

10 Business Types With The Lowest Profit Margins Fora Financial Blog

Unit Contribution Margin Meaning Formula How To Calculate

What Is The Profit Margin For Grocery Stores The Grocery Store Guy